Evaluate your current housing expenses

When it comes to managing our finances, one area that often eats up a large portion of our budget is housing expenses. Whether you rent or own a property, evaluating these expenses on a regular basis can help you identify potential savings and make adjustments to your budget. By taking the time to review and analyze your current housing expenses, you may discover ways to reduce costs and free up funds for other financial goals.

One way to evaluate your current housing expenses is by examining your monthly rent or mortgage payments. Start by looking at the amount you are currently paying and compare it to the market rates in your area. Are you paying more than the average? If so, it may be worth considering negotiations with your landlord or mortgage lender to lower the rent or mortgage rates. Highlight on the importance of strong negotiation skills here.

Another aspect of housing expenses to consider is the cost of utilities. Take a close look at your monthly utility bills for electricity, water, gas, and any other services you use. Can you identify any areas where you could reduce your consumption and lower your bills? Simple changes, such as adjusting your thermostat, using energy-efficient appliances, or installing low-flow fixtures, can make a significant impact on your utility costs.

Additionally, it’s essential to take into account any additional expenses related to your housing, such as maintenance and repairs, insurance, property taxes, and homeowner association fees. These costs can add up quickly and might require some budget adjustments. Consider exploring alternative insurance providers or reassessing your coverage to find potential savings.

- Perform a thorough evaluation of your housing expenses

- Research market rates for rent or mortgage payments in your area

- Negotiate with your landlord or mortgage lender if necessary

- Identify ways to reduce energy consumption and lower utility bills

- Review additional housing expenses, such as maintenance, repairs, insurance, and taxes

- Make adjustments to your budget and allocate savings to other financial goals

| Expense | Monthly Cost |

|---|---|

| Rent/Mortgage | $1,200 |

| Electricity | $100 |

| Water | $50 |

| Gas | $75 |

| Maintenance/Repairs | $200 |

| Insurance | $80 |

| Property Taxes | $150 |

| HOA Fees | $50 |

By evaluating your current housing expenses, you can gain a better understanding of where your money is going and identify areas for potential savings. Taking steps to lower your rent or mortgage rates, reduce energy consumption, and review additional housing costs can have a significant impact on your overall budget. Remember, every dollar saved on housing expenses is a dollar that can be allocated towards your financial goals or building an emergency fund.

Consider downsizing to a smaller property

Considering downsizing to a smaller property is a smart move to make for many individuals or families. It not only helps to reduce housing expenses, but also provides numerous other benefits. When you downsize, you are essentially choosing to live in a smaller space, which can have a positive impact on your financial situation. It allows you to save money on mortgage or rent payments, as well as on utilities and maintenance costs. Moreover, downsizing promotes a simpler and more minimalistic lifestyle, which can bring about a sense of freedom and contentment.

One of the main advantages of downsizing is the potential to significantly reduce housing expenses. Whether you are renting or buying a property, opting for a smaller space can lead to substantial savings. A smaller property generally means lower mortgage payments, or a decrease in monthly rent. Additionally, the cost of utilities, such as electricity, heating, and cooling, is typically lower in smaller spaces. This reduction in expenses allows you to free up more of your income for other priorities, such as saving for the future, paying off debt, or pursuing your passions and interests.

Aside from the financial benefits, downsizing to a smaller property can have a positive impact on your overall well-being. Living in a smaller space often requires you to declutter and minimize your belongings. Embracing minimalism can help create a more organized and stress-free living environment. With fewer possessions, you may find it easier to maintain a clean and tidy space, leading to a sense of calm and relaxation. Moreover, downsizing can also result in less time spent on household chores and maintenance, freeing up time for activities that you truly enjoy.

Explore alternative housing options

When it comes to choosing a place to live, many people automatically think of buying a house or renting an apartment. However, there are actually many alternative housing options that can provide unique and exciting living experiences. These alternatives can range from unconventional types of houses to innovative and eco-friendly living arrangements. In this blog post, we will explore some of these alternative housing options that you may not have considered before.

Co-living spaces: Co-living spaces have been gaining popularity in recent years, especially among young professionals and digital nomads. These spaces typically consist of fully furnished apartments or houses, where residents have their own private bedroom but share common areas such as the kitchen, living room, and sometimes even bathrooms. The concept of co-living promotes a sense of community and often includes additional benefits like cleaning services, social events, and even access to co-working spaces.

Tiny homes: If you are looking to downsize and simplify your living space, tiny homes might be the perfect option for you. These small and compact houses are typically less than 500 square feet in size and can be either stationary or on wheels. Despite their size, tiny homes are designed to maximize functionality and often include creative storage solutions. Living in a tiny home allows you to embrace minimalism and reduce your environmental footprint while still having a comfortable and stylish living space.

Eco-villages: For those who value sustainability and community living, eco-villages offer a unique alternative. These intentional communities are designed with a focus on ecological and social sustainability. Eco-villages often have shared resources such as gardens, workshops, and communal spaces, fostering a sense of togetherness and cooperation. Living in an eco-village allows you to live in harmony with nature while embracing a more sustainable and self-sufficient lifestyle.

- Alternative housing options can provide unique living experiences.

- Co-living spaces promote a sense of community and offer additional benefits.

- Tiny homes allow for downsizing and embracing minimalism.

- Eco-villages focus on sustainability and foster a sense of togetherness.

| Type of Alternative Housing | Description |

|---|---|

| Co-living spaces | Shared living arrangements with private bedrooms and shared common areas. |

| Tiny homes | Compact houses designed to maximize functionality and embrace minimalism. |

| Eco-villages | Intentional communities focused on sustainability and communal living. |

Exploring alternative housing options can open up a world of possibilities for finding a unique and fulfilling living arrangement. Whether you choose to live in a co-living space, a tiny home, or an eco-village, these alternatives can provide not only a place to live but also a sense of community and a chance to embrace a more sustainable lifestyle. So, why not step outside the traditional housing options and explore the amazing alternatives available to you?

Negotiate lower rent or mortgage rates

When it comes to managing your housing expenses, one effective strategy is to negotiate lower rent or mortgage rates. With some effort and know-how, you may be able to secure a better deal and save a significant amount of money each month. Here are some tips to help you navigate the negotiation process:

Research the Market: Before you start negotiations, it’s crucial to understand the current rental or housing market. Look at similar properties in your area and check their listed prices. This will give you an idea of the going rate and help you determine the appropriate range to aim for.

Prepare your Case: Arm yourself with information that supports your request for a lower rate. Highlight any maintenance or repair issues in the property, discuss local market trends, and emphasize your history as a reliable and responsible tenant. Additionally, if you have a good credit score or a steady income, make sure to mention these factors to strengthen your case.

Be Polite and Professional: Approach your landlord or mortgage lender with a polite and respectful attitude. Explain your situation and the reasons for your request without sounding demanding or entitled. Show that you are willing to negotiate and find a mutually beneficial solution.

- Consider a Longer Lease: Offering to sign a longer lease term may increase your chances of negotiating a lower rent or mortgage rate. This provides stability for the landlord or lender and reduces the risk of vacancies, making them more likely to accommodate your request.

- Propose Upgrades or Add-ons: If you’re negotiating with a landlord, you can suggest making improvements to the property, such as painting, upgrading appliances, or adding amenities like a gym or a laundry room. These added benefits might persuade them to lower the rent in exchange.

- Get Multiple Quotes: If you’re in the process of refinancing your mortgage, reach out to multiple lenders and compare their offers. This not only helps you find the best rates but also provides you with leverage during negotiations.

| Benefits of Negotiating | Considerations |

|---|---|

| 1. Reduced Financial Strain: Lowering your rent or mortgage payments can free up more money in your budget, allowing you to allocate those funds towards other important expenses or savings goals. | 1. Possible Rejection: While negotiation is worth a try, there is always a chance that your landlord or lender may decline your request. Be prepared for the possibility that your efforts may not be successful. |

| 2. Improved Cash Flow: Negotiating lower rates can provide you with more disposable income, making it easier to manage your monthly bills and potentially save for the future. | 2. Long-term Commitment: Be mindful of the terms and conditions associated with renegotiating your rental or mortgage agreement. Ensure that the proposed changes align with your long-term housing goals. |

| 3. Opportunity for Savings: Lowering your housing expenses can result in significant savings over time. Even a small reduction can add up to substantial savings in the long run. | 3. Impact on Quality: While negotiating a lower rate is appealing, consider the potential impact on the quality of the property or the level of services you receive. Make sure the proposed adjustments meet your expectations. |

Take advantage of government programs or subsidies

Government programs and subsidies can be a valuable resource for individuals and families looking to reduce their housing expenses. These programs are designed to provide financial assistance and support to eligible individuals, helping them secure affordable housing and alleviate the burden of high rent or mortgage payments. Whether you are a first-time homebuyer, a low-income individual, or someone struggling to make ends meet, taking advantage of government programs and subsidies can make a significant difference in your housing expenses.

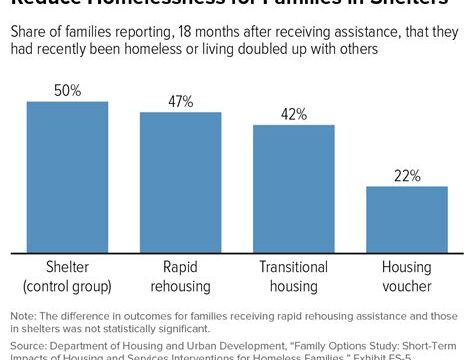

One of the most well-known government programs is the Section 8 Housing Choice Voucher Program. This program provides rental assistance to low-income individuals and families, allowing them to secure housing in the private market. Participants in the program pay 30% of their income towards rent, with the remainder covered by the program. This not only reduces the financial strain on individuals and families but also ensures that they have access to safe and affordable housing.

In addition to the Section 8 program, there are various other government programs and subsidies available at the federal, state, and local levels. These programs aim to provide financial assistance for housing-related expenses such as down payments, mortgage payments, and energy-efficient home improvements. For example, the Federal Housing Administration (FHA) offers loans with low down payments and flexible credit requirements, making it easier for individuals to become homeowners.

- First-Time Homebuyer Assistance Programs

- Low-Income Home Energy Assistance Program (LIHEAP)

- Weatherization Assistance Program (WAP)

- Home Affordable Modification Program (HAMP)

It’s important to note that the availability and eligibility criteria for government programs and subsidies may vary based on your location. Therefore, it is recommended to research and explore the specific programs and subsidies offered in your area. This can typically be done through government websites, housing authorities, or nonprofit organizations that specialize in housing assistance.

| Program | Description | Eligibility |

|---|---|---|

| Section 8 Housing Choice Voucher Program | Rental assistance for low-income individuals and families | Based on income and household size |

| Federal Housing Administration (FHA) Loans | Loans with low down payments for homebuyers | Based on creditworthiness and income |

| LIHEAP | Financial assistance for energy bills | Based on income and household size |

| WAP | Free home improvements for energy efficiency | Based on income and household size |

By taking advantage of these government programs and subsidies, you can significantly reduce your housing expenses and improve your financial situation. Whether you are renting or looking to become a homeowner, exploring these options can provide you with the support you need to secure affordable and quality housing. Remember to research and understand the eligibility requirements and application processes for each program to ensure a smooth and successful experience. With the help of these resources, you can take control of your housing expenses and achieve greater financial stability.

Reduce energy consumption to lower utility bills

Your energy consumption directly affects your utility bills. By reducing your energy usage, you can significantly lower your monthly expenses and also contribute to a greener environment. Here are some effective strategies to help you reduce energy consumption and save money on your utility bills:

1. Upgrade to energy-efficient appliances: One of the most effective ways to reduce energy consumption is to replace your old appliances with energy-efficient ones. Look for appliances with the Energy Star label, as they are designed to consume less energy without compromising functionality or performance.

2. Insulate your home: Proper insulation can help maintain a comfortable temperature inside your home without relying heavily on heating or cooling systems. Insulate your walls, windows, and doors to prevent heat transfer and reduce the need for constant heating or air conditioning.

3. Use natural lighting and efficient lighting: Take advantage of natural lighting during the day by keeping curtains open and utilizing skylights or windows. When artificial lighting is necessary, opt for energy-saving LED or CFL bulbs, which consume less electricity and last longer than traditional incandescent bulbs.

4. Adjust your thermostat: Lowering your thermostat by a few degrees in winter and raising it in summer can have a significant impact on your energy consumption and ultimately your utility bills. Consider investing in a programmable thermostat to automatically adjust the temperature based on your schedule.

| Appliance | Average Annual Energy Cost |

|---|---|

| Refrigerator | $100 |

| Washing Machine | $50 |

| Dishwasher | $30 |

| Air Conditioner | $250 |

| Heater | $200 |

5. Unplug electronics when not in use: Electronics and appliances that are plugged in, even when not in use, continue to consume energy. Be mindful of devices such as televisions, computers, and phone chargers, and unplug them when they are not being used to avoid unnecessary energy consumption.

6. Use energy-efficient windows: Windows play a significant role in heat transfer. Investing in energy-efficient windows with proper insulation can help retain heat during winter and reduce the need for excessive heating, thereby lowering your energy consumption.

Implementing these strategies can help you reduce your energy usage and subsequently lower your utility bills. Not only will you save money, but you will also contribute to a more sustainable future by reducing your carbon footprint. Take proactive steps towards energy efficiency, and enjoy the benefits of both financial savings and environmental responsibility.

Share living expenses with a roommate or housemate

Sharing living expenses with a roommate or housemate can be a great way to save money and reduce financial burden. Whether you are a student, young professional, or just looking to cut down on expenses, finding a roommate can provide numerous benefits. By splitting the costs of rent, utilities, and other household bills, you can significantly lighten your financial load. Additionally, sharing living expenses with someone can offer companionship, shared responsibilities, and even the opportunity to build long-lasting friendships.

Financial Benefits: One of the most obvious advantages of sharing living expenses with a roommate or housemate is the financial benefit. By splitting the costs, you can save a substantial amount of money each month. For example, if you currently pay $1,500 per month for rent and utilities, sharing these expenses with a roommate would cut that amount in half, potentially saving you $750 or more. This extra money can be allocated towards other financial goals, such as saving for a vacation, paying off debt, or investing for the future.

Shared Responsibilities: Living with a roommate or housemate also means sharing responsibilities around the house. This can make certain tasks, such as cleaning, cooking, and grocery shopping, more manageable and less time-consuming. By dividing household chores, you can free up more time to focus on your career, hobbies, or personal interests. Additionally, sharing responsibilities can foster a sense of teamwork and camaraderie, making your living environment more enjoyable and harmonious.

Building Relationships: Sharing living expenses with a roommate or housemate not only provides financial benefits but also the opportunity to build relationships. Living with someone allows you to get to know them on a deeper level, share experiences, and create lasting memories. Roommates can become friends, confidants, and support systems. They can provide companionship, emotional support, and a sense of community. Living with a compatible roommate can enhance your overall quality of life and create a positive and enriching living environment.

In conclusion, sharing living expenses with a roommate or housemate can be a wise financial decision that offers various benefits. From reducing financial burden to sharing responsibilities and building relationships, having a roommate can greatly improve your overall well-being. If you are considering this option, make sure to carefully select a compatible roommate and establish clear communication and expectations from the beginning. With proper planning and understanding, sharing living expenses can provide both financial relief and personal growth.

Embrace minimalism and declutter your living space

In today’s fast-paced world, many people are overwhelmed by the constant barrage of information, possessions, and obligations. One way to find solace in this chaos is by embracing minimalism and decluttering your living space. Minimalism is not just a design trend; it is a philosophy that encourages you to simplify your life by owning fewer possessions and focusing on what truly brings you joy and contentment.

By decluttering your living space, you can create a calm and peaceful environment that promotes relaxation and mindfulness. Clutter can lead to stress, anxiety, and feelings of overwhelm. By removing unnecessary items from your home, you can free up physical and mental space, allowing you to breathe easier and think more clearly.

One of the key principles of minimalism is to only keep items that serve a purpose or bring you joy. This means letting go of things that no longer serve you or that you have outgrown. Start by going through each room in your home and sorting items into three categories: keep, donate/sell, and discard. Be honest with yourself and ask if each item truly adds value to your life. If the answer is no, it’s time to let it go.

In addition to decluttering, minimalism also encourages conscious consumption. Before bringing new items into your home, consider whether you really need them and how they align with your values and goals. This mindset can help you avoid impulse purchases and reduce unnecessary spending, leading to financial freedom and a greater sense of fulfillment.

By embracing minimalism and decluttering your living space, you can create a sanctuary that reflects your true priorities and values. Surrounding yourself with only the things you love can bring a sense of peace and contentment to your daily life. So, why not take the plunge and start embracing minimalism today?

- Create a calm and peaceful environment by decluttering your living space

- Remove unnecessary items to free up physical and mental space

- Only keep items that serve a purpose or bring you joy

- Practice conscious consumption to avoid unnecessary spending

- Embrace minimalism to find peace and contentment in your daily life

| Benefits of Embracing Minimalism | Steps to Decluttering Your Living Space |

|---|---|

| 1. Reduces stress and anxiety | 1. Start by going through each room and sorting items |

| 2. Fosters a sense of clarity and focus | 2. Categorize items into keep, donate/sell, and discard |

| 3. Promotes mindfulness and intentionality | 3. Be honest about the value each item brings to your life |

Frequently Asked Questions

1. How can I evaluate my current housing expenses?

To evaluate your current housing expenses, you can start by making a list of all your ongoing housing costs, including mortgage or rent payments, utility bills, property taxes, maintenance fees, and insurance. Compare this total to your monthly income to determine the percentage of your income that goes towards housing. You can also analyze your spending habits and identify areas where you can cut back or make adjustments to reduce expenses.

2. What are the benefits of downsizing to a smaller property?

Downsizing to a smaller property can have several benefits. Firstly, it can significantly reduce your housing expenses, including mortgage payments, utilities, and maintenance costs. Secondly, it can simplify your life by reducing the amount of space you need to maintain and clean. Additionally, downsizing can free up equity that you can use for other financial goals, such as investing, saving for retirement, or paying off debt.

3. What are some alternative housing options to consider?

There are various alternative housing options you can consider. Some alternatives include living in a tiny house, condominium, mobile home, or co-living space. Each option has its own advantages and considerations, so it’s important to research and evaluate which one aligns best with your lifestyle, budget, and long-term goals.

4. How can I negotiate lower rent or mortgage rates?

To negotiate lower rent or mortgage rates, you can start by researching the current market rates in your area. Armed with this information, you can approach your landlord or mortgage lender and express your desire for a lower rate. Present any evidence or reasons that support your request, such as comparable rental prices or market trends. It’s important to be polite and professional during negotiations and be prepared for the possibility of not reaching an agreement.

5. Are there any government programs or subsidies available to help with housing costs?

Yes, there are government programs and subsidies available that can help with housing costs. These programs may vary depending on your location and situation. Some options to explore include low-income housing assistance, rental subsidies, first-time homebuyer programs, and energy efficiency incentives. It’s recommended to research and contact local housing authorities or government agencies to inquire about the specific programs available in your area.

6. How can I reduce energy consumption to lower utility bills?

To reduce energy consumption and lower utility bills, you can take several steps. Start by adopting energy-efficient habits, such as turning off lights when not in use, unplugging electronics, and using energy-saving appliances. Additionally, improve the insulation in your home, seal air leaks, and consider investing in energy-efficient upgrades like LED lighting or programmable thermostats. Lastly, be mindful of your water usage and consider installing low-flow fixtures or using water-saving appliances.

7. What are the advantages of sharing living expenses with a roommate or housemate?

Sharing living expenses with a roommate or housemate can have several advantages. Firstly, it can help reduce the financial burden of housing costs, as you’ll be splitting rent or mortgage payments, utilities, and other expenses. This can create significant savings over time. Secondly, living with others can provide companionship and the opportunity to share household responsibilities. However, it’s important to choose compatible roommates and establish clear communication and financial agreements to ensure a harmonious living arrangement.