Initial costs of buying a home

Buying a home is an exciting milestone in life, but it’s important to be aware of the initial costs involved. Before making a purchase, it’s crucial to understand the various expenses that come with buying a home. These costs go beyond just the purchase price of the property and can significantly impact your budget. Let’s take a closer look at some of the initial costs to consider when buying a home.

1. Down Payment: One of the most significant initial costs of buying a home is the down payment. This is the amount of money you pay upfront towards the purchase price. In most cases, a down payment is typically a percentage of the total purchase price. The percentage required can vary depending on factors such as the type of mortgage and your creditworthiness. It’s important to set aside a substantial amount for the down payment to secure a more favorable mortgage rate.

2. Closing Costs: When buying a home, you’ll also need to consider the closing costs. These are the fees associated with the completion of the real estate transaction. Closing costs can include expenses such as lender fees, attorney fees, appraisal fees, title insurance, and more. It’s essential to carefully review the estimated closing costs provided by your lender and plan accordingly to avoid any financial surprises.

3. Home Inspection: Another cost to consider is the home inspection. Before finalizing the purchase, it’s highly recommended to hire a professional home inspector. The inspector will thoroughly assess the condition of the property and identify any potential issues or repairs needed. While this is an additional expense, it can be crucial in avoiding unexpected repair costs in the future. Make sure to factor in the cost of a home inspection when budgeting for the initial expenses of buying a home.

In summary, buying a home involves more than just the purchase price. It’s essential to be aware of the initial costs associated with homeownership. These include the down payment, closing costs, and the cost of a home inspection. Properly budgeting for these expenses will help ensure a smooth home buying process and minimize any financial strain. By understanding the initial costs involved in buying a home, you can make a more informed decision and enjoy your new home without any financial surprises.

Understanding mortgage payments and interest rates

Understanding Mortgage Payments and Interest Rates

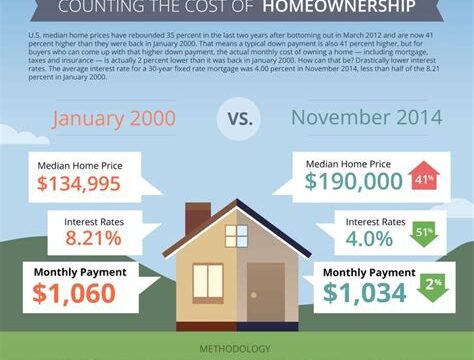

When it comes to buying a home, understanding mortgage payments and interest rates is crucial. These two factors play a significant role in determining the overall cost of homeownership. Whether you are a first-time homebuyer or looking to refinance your existing mortgage, it is essential to have a clear understanding of how mortgage payments work and how interest rates can impact your finances in the long run.

Firstly, let’s delve into mortgage payments. A mortgage payment is the amount of money you pay each month to your lender to repay the loan you borrowed to purchase your home. It typically consists of two main components: principal and interest. The principal is the amount borrowed, while the interest is the cost charged by the lender for borrowing the money. Additionally, mortgage payments might also include additional costs such as property taxes and homeowner’s insurance, which will be discussed in further detail later in this blog post.

Now, let’s shift gears and discuss interest rates. Interest rates, expressed as a percentage, determine the amount of interest you will pay over the life of your mortgage. They can be fixed or adjustable, meaning they can either remain the same throughout the loan term or fluctuate over time. When interest rates are low, homeowners can benefit from lower monthly mortgage payments. Conversely, higher interest rates can result in increased monthly payments and a more substantial overall cost of borrowing.

It is crucial to consider your financial situation and long-term goals when choosing between different mortgage options. Understanding how mortgage payments and interest rates work together can help you make informed decisions and ensure that you select the mortgage that aligns with your budget and future plans. By carefully evaluating the terms and conditions of various mortgage offers, you can secure a loan that offers favorable terms and allows you to achieve your dream of homeownership without overburdening your finances.

Key takeaways:

- Understanding mortgage payments and interest rates is essential when buying a home.

- Mortgage payments consist of principal, interest, and additional costs.

- Interest rates determine the overall cost of borrowing and can impact monthly payments.

- Consider your financial situation and long-term goals when choosing a mortgage.

- Evaluating different mortgage offers helps find a loan that fits your budget and needs.

Table: Mortgage Payment Breakdown

| Component | Definition |

|---|---|

| Principal | The amount borrowed to purchase the home. |

| Interest | The cost charged by the lender for borrowing the money. |

| Additional Costs | Includes property taxes and homeowner’s insurance. |

Hidden expenses to consider when owning a home

When purchasing a home, it’s easy to get caught up in the excitement of finding your dream house and planning for the future. However, it’s important to remember that there are hidden expenses that come with homeownership. These expenses can add up quickly and impact your budget if you’re not prepared. In this blog post, we will explore the hidden expenses to consider when owning a home, so you can plan ahead and avoid any financial surprises.

One of the hidden expenses of homeownership is property taxes. Property taxes are imposed by local governments and vary depending on the value of your property. They are typically paid annually or semi-annually and can be a significant expense. It’s important to research the property tax rates in your area and include them in your budget to avoid any unexpected costs.

Homeowners insurance is another important expense to consider. Insurance premiums can vary based on factors such as the location of your home, its value, and the type of coverage you choose. It’s crucial to shop around for the best insurance rates and ensure that you have adequate coverage to protect your investment.

In addition to property taxes and insurance, home maintenance and repair costs should also be factored into your budget. Over time, every home requires maintenance and repairs, such as fixing a leaky roof or replacing a faulty appliance. These costs can vary depending on the age and condition of your home, so it’s essential to set aside a portion of your budget specifically for maintenance and repairs.

By considering these hidden expenses when owning a home, you can better prepare yourself for the financial responsibilities that come with homeownership. Researching property tax rates, insurance options, and budgeting for maintenance and repairs will help you avoid any unexpected surprises and ensure that you can comfortably enjoy your new home for years to come.

List of Hidden Expenses to Consider When Owning a Home:

- Property taxes

- Homeowners insurance

- Home maintenance and repair costs

Table: Example of Property Tax Rates by Location

| Location | Property Tax Rate |

|---|---|

| City A | 1.5% |

| City B | 2.0% |

| City C | 1.2% |

Maintenance and repair costs over time

When you become a homeowner, it’s important to understand that along with the many joys of owning a home, there are also responsibilities. One of these responsibilities includes the maintenance and repair costs that come with the territory. While it’s easy to get caught up in the excitement of buying a new home, it’s crucial to consider the long-term costs involved in maintaining and repairing your property.

First and foremost, it’s important to recognize that regular maintenance is key to preventing major issues and costly repairs down the line. Routine tasks such as inspecting and cleaning gutters, servicing the HVAC system, and checking for leaks can help identify potential problems early on and save you from expensive fixes later.

Additionally, creating a budget specifically for home maintenance and repairs is essential. Set aside a portion of your income each month to build an emergency fund that can be used to tackle unexpected projects or repairs. Whether it’s fixing a leaky roof, replacing a broken appliance, or updating outdated plumbing, having a designated fund for these expenses will save you from financial stress in the long run.

It’s also crucial to consider the age and condition of your home when assessing potential maintenance and repair costs. Older homes often require more upkeep and may have hidden issues that need to be addressed. When purchasing a new home, consider hiring a professional inspector to thoroughly assess the property and provide insight into any potential maintenance or repair costs that may arise in the future.

Lastly, it’s worth mentioning that certain home features and materials may contribute to higher maintenance and repair costs. For example, a house with a large backyard and extensive landscaping will likely require more frequent care and maintenance. Similarly, homes with older plumbing or outdated electrical systems may require more repairs over time.

In conclusion, owning a home comes with its fair share of maintenance and repair costs. By staying proactive with regular maintenance, budgeting for unexpected expenses, and considering the unique characteristics of your home, you can better prepare for these costs and ensure that your investment remains in good condition for years to come.

Insurance premiums and coverage options

When purchasing a home, it’s important to consider not only the initial costs and mortgage payments, but also the ongoing expenses that come with homeownership. One of these expenses is homeowners insurance. In this blog post, we will explore insurance premiums and coverage options to help you understand their impact on your budget.

Insurance premiums vary depending on several factors, including the location and condition of your home, the amount of coverage you need, and your personal circumstances. It’s essential to obtain quotes from multiple insurance providers to compare prices and coverage options. While it may be tempting to choose the cheapest premium, it’s crucial to ensure that the policy provides adequate coverage for your home and belongings. Remember, a low premium may mean less coverage or higher deductibles.

When evaluating insurance coverage options, consider the types of risks specific to your area. For example, if you live in an area prone to natural disasters like hurricanes or earthquakes, you may need additional coverage beyond a standard homeowners policy. Keep in mind that certain perils, such as floods, may require separate insurance coverage altogether. It’s important to carefully review the policy and understand what is covered and what is excluded.

Another factor to consider when choosing homeowners insurance is the level of customer service and support provided by the insurance company. In the event of a claim, you want to ensure that the process is efficient and that your claims will be handled promptly and fairly. Do your research and read reviews or ask for recommendations from friends and family to find an insurance company with a good reputation for customer service.

In addition to homeowners insurance, you may also want to consider optional coverage for valuable items such as jewelry, art, or electronics. These items may have limited coverage under a standard policy, so it’s important to determine if additional coverage is necessary to fully protect your assets. Take an inventory of your belongings and discuss with your insurance provider to determine the appropriate coverage for your needs.

List of key takeaways from this blog post:

- Obtain quotes from multiple insurance providers

- Ensure the policy provides adequate coverage

- Consider additional coverage for specific risks

- Research the insurance company’s reputation for customer service

- Consider optional coverage for valuable items

Table comparing insurance premiums and coverage options:

| Insurance Provider | Premium | Coverage Details |

|---|---|---|

| Company A | $800/year | Standard coverage with additional flood insurance |

| Company B | $900/year | Comprehensive coverage including valuable items |

| Company C | $700/year | Basic coverage with high deductible |

Calculating property taxes and their impact on your budget

When it comes to buying a home, there are various expenses that need to be taken into account. One of the most important costs to consider is property taxes. Property taxes play a significant role in the overall budget of a homeowner. These taxes are levied by local governments and are usually based on the assessed value of the property. Calculating property taxes can seem intimidating at first, but understanding how they are determined can help you plan and manage your budget effectively.

Firstly, it is important to note that property taxes vary depending on the location of the property. Each state and even each city or county within a state may have different tax rates. Property tax rates are usually expressed as a percentage of the assessed value of the property. The assessed value is determined by the local tax assessor’s office and is based on factors such as the property’s size, condition, and location. Once the assessed value is determined, the tax rate is applied to calculate the annual property tax amount.

Additionally, it is worth mentioning that some states have additional taxes, such as school district taxes or special assessments, which can further impact the property tax amount. These additional taxes are often used to fund local infrastructure projects or public schools. Therefore, it is essential to research and understand the specific tax laws and regulations in your area to accurately calculate your property taxes.

Property taxes can have a significant impact on your budget as a homeowner. They are typically billed annually or semi-annually, depending on the jurisdiction. Therefore, it is crucial to factor in this expense when creating your budget. Failure to account for property taxes can lead to financial strain and unexpected costs. It is advisable to set aside a portion of your monthly income for property taxes or create a separate savings account specifically for this purpose. By planning ahead and considering the impact of property taxes, you can ensure that you are financially prepared and avoid any financial burdens associated with homeownership.

In conclusion, calculating property taxes and understanding their impact on your budget is essential for any homeowner. Property taxes are determined by local governments and can vary based on the assessed value of the property and the tax rates in your area. These taxes can have a significant impact on your overall budget and should be considered when planning for homeownership. By accurately calculating and accounting for property taxes, you can effectively manage your finances and ensure a smooth homeownership experience.

Factors to consider when budgeting for utilities

When it comes to budgeting for utilities, there are several factors that homeowners need to consider. Utilities can be a significant expense, and understanding how to budget for them effectively is essential for managing your overall household budget. By taking the time to evaluate your needs, research costs, and implement energy-efficient practices, you can ensure that your utility expenses are kept under control.

1. Evaluate your lifestyle and needs: Before you start budgeting for utilities, it’s important to assess your lifestyle and needs. Consider the size of your household, the appliances you use, and your overall energy consumption. If you have a large family or frequently use energy-intensive appliances, such as a pool pump or hot tub, your utility expenses will likely be higher compared to a smaller household.

2. Research utility rates: Utility rates can vary significantly depending on your location and the service providers available to you. Take the time to research the utility rates in your area for electricity, water, gas, and any other services you may require. This information will give you a better idea of what to expect when budgeting for utilities.

3. Implement energy-efficient practices: One of the most effective ways to reduce utility expenses is to implement energy-efficient practices in your home. This can include upgrading to energy-efficient appliances, using LED light bulbs, properly insulating your home, and adjusting your thermostat settings. By making these changes, you can lower your energy consumption and ultimately reduce your utility costs.

4. Consider renewable energy options: In recent years, renewable energy options have become more accessible and affordable. Solar panels, for example, can help offset your electricity costs by generating your own clean energy. While the upfront costs may be significant, the long-term savings can be substantial. Additionally, many areas offer government incentives and rebates for installing renewable energy systems.

| Utility | Estimated Monthly Cost |

|---|---|

| Electricity | $100 |

| Water | $50 |

| Gas | $70 |

| Internet | $60 |

5. Monitor and track your usage: Once you have established a budget for your utilities, it’s important to monitor and track your usage. Keep an eye on your monthly bills and compare them to your budgeted amounts. This will help you identify any unforeseen changes in consumption and allow you to make adjustments if necessary.

Conclusion: Budgeting for utilities is a crucial aspect of managing your overall household expenses. By evaluating your lifestyle, researching rates, implementing energy-efficient practices, considering renewable energy options, and monitoring your usage, you can effectively budget for utilities and keep your costs under control. Remember, every small step towards reducing energy consumption can make a significant difference in the long run.

Homeowners association fees and their impact on expenses

Homeowners association (HOA) fees are a common expense that homeowners should consider when budgeting for their expenses. These fees are paid to the HOA, which is responsible for maintaining and managing shared areas and amenities in a residential community. The fees can vary depending on the location, size, and amenities of the community, and they can have a significant impact on a homeowner’s budget.

One of the main benefits of HOA fees is that they cover the cost of maintaining shared areas and amenities in the community. This can include landscaping, pool maintenance, snow removal, and repairs to common areas such as sidewalks and parking lots. By pooling the resources of all homeowners, the HOA can ensure that these areas are well-maintained and that everyone in the community can enjoy them.

However, it’s important for homeowners to understand that HOA fees are an ongoing expense that they will need to budget for. These fees are usually paid on a monthly or quarterly basis, and they can range from a few hundred dollars to several thousand dollars per year. Homeowners should factor these fees into their monthly budget to ensure that they can comfortably afford them.

- Impact on Expenses: HOA fees can have a significant impact on a homeowner’s expenses. In addition to their mortgage payments, homeowners will need to budget for these fees on a regular basis. It’s important to review the HOA budget and fee schedule before purchasing a home to ensure that the fees are affordable and reasonable for your financial situation.

- Benefits and Amenities: While HOA fees may be an additional expense, they often come with benefits and amenities that can enhance your living experience. These can include access to a swimming pool, fitness center, clubhouse, or community events. Consider the value of these amenities when evaluating the impact of HOA fees on your expenses.

- Financial Responsibility: As a homeowner, it’s important to understand your financial responsibility within the HOA. In addition to the annual fees, homeowners may be required to contribute to special assessments or reserve funds for major repairs or improvements in the community. Be sure to factor these potential expenses into your budget as well.

| Factors to Consider: | Explanation: |

|---|---|

| Location and Size of the Community | The location and size of the community can significantly impact the HOA fees. Larger communities with more amenities tend to have higher fees. |

| Amenities and Services Provided | The amenities and services provided by the HOA, such as landscaping, security, and maintenance of common areas, can affect the fees. |

| Financial Health of the HOA | The financial health of the HOA is important to consider. A well-managed HOA with adequate reserves will be better equipped to handle future expenses without significant fee increases. |

In conclusion, homeowners association fees are an important consideration when budgeting for your expenses as a homeowner. While they can have a significant impact on your budget, they also provide benefits and amenities that can enhance your living experience. It’s crucial to carefully review the HOA fees and budget before purchasing a home to ensure that they are affordable and reasonable for your financial situation. By understanding the factors that influence the fees and your financial responsibility within the HOA, you can make an informed decision and effectively manage your homeownership expenses.

Frequently Asked Questions

Question 1: What are the initial costs of buying a home?

The initial costs of buying a home typically include the down payment, closing costs, and any fees associated with obtaining a mortgage. These costs can vary but it’s important to budget for them before purchasing a home.

Question 2: How can I understand mortgage payments and interest rates?

Mortgage payments are the monthly amount you’ll need to pay to your lender to repay your home loan. Interest rates, on the other hand, determine the cost of borrowing money. It’s important to fully understand both aspects to make informed decisions about your mortgage.

Question 3: What hidden expenses should I consider when owning a home?

Aside from the initial costs, there are ongoing expenses to consider when owning a home. These can include property taxes, homeowners insurance, private mortgage insurance (if applicable), and costs for regular maintenance and repairs.

Question 4: How much should I budget for maintenance and repair costs over time?

It’s recommended to budget around 1-2% of the home’s value per year for maintenance and repair costs. This can cover expenses such as routine maintenance, occasional repairs, and unforeseen emergencies.

Question 5: What factors should I consider when calculating property taxes and their impact on my budget?

Property taxes are typically based on the assessed value of your home and the local tax rate. Factors such as location, school districts, and property improvements can affect the amount of property taxes you’ll need to pay. Considering these factors is important when budgeting for your home expenses.

Question 6: How do insurance premiums and coverage options impact homeowners?

Insurance premiums can vary depending on factors such as the location of your home, its value, and the coverage options you choose. It’s important to evaluate different coverage options and their costs to ensure you have adequate protection for your home and belongings.

Question 7: How do homeowners association fees impact expenses?

If you reside in a community with a homeowners association (HOA), you’ll likely need to pay fees to cover shared community expenses such as maintenance of common areas. It’s essential to consider these fees when budgeting for homeownership and understand what services and amenities they provide.