Introduction to Tax Planning for Educators

Tax planning is an essential aspect of financial management for educators. As educators, you have the responsibility to not only educate and inspire the next generation but also to make informed decisions about your finances, including tax planning. This blog post will provide you with an introduction to tax planning specifically tailored for educators.

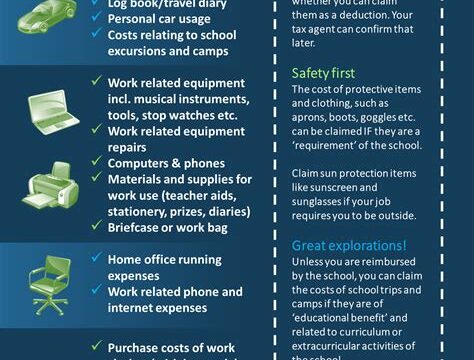

When it comes to tax planning, educators have unique considerations and potential deductions that can help minimize tax liabilities. The key is to have a clear understanding of the various tax provisions and benefits available to you as an educator. By taking advantage of these opportunities, you can maximize your after-tax income and ensure that your hard-earned money is being used wisely.

One of the primary tax benefits available to educators is the Educator Expense Deduction. This deduction allows eligible teachers and educators to deduct up to $250 from their taxable income for unreimbursed expenses related to classroom supplies and professional development. This can include expenses for books, supplies, computer equipment, and even software used for educational purposes.

- Books and Supplies: Educators can deduct expenses incurred in purchasing books, teaching materials, or supplies used in the classroom.

- Professional Development: Expenses for workshops, conferences, or other professional development activities can also be deducted.

- Computer Equipment and Software: If you use a computer or software for educational purposes, you may be able to deduct the cost.

Additionally, educators can also take advantage of other tax strategies such as utilizing education-related tax credits, maximizing deductions for classroom supplies, exploring home office deductions, and navigating retirement contributions and tax benefits. These strategies can provide significant tax savings and enhance your overall financial well-being.

| Tax Strategies | Description |

|---|---|

| Education-related Tax Credits | Take advantage of tax credits such as the American Opportunity Credit or the Lifetime Learning Credit for qualified education expenses. |

| Maximizing Deductions for Classroom Supplies | Keep track of your out-of-pocket expenses for classroom supplies and utilize the Educator Expense Deduction to minimize your taxable income. |

| Exploring Home Office Deductions | If you use a dedicated space in your home for educational purposes, you may qualify for a home office deduction. |

| Navigating Retirement Contributions and Tax Benefits | Learn about the available retirement savings options for educators, such as 403(b) plans, and the associated tax benefits. |

By understanding the tax benefits and strategies specific to educators, you can proactively plan and optimize your tax situation. Whether it’s deducting continuing education costs or taking advantage of retirement contributions, tax planning allows you to keep more of your hard-earned money and make better financial decisions.

Stay tuned as we explore each of these tax planning strategies in detail in our upcoming blog posts. We will provide you with in-depth information, tips, and real-life examples to help you make the most of your tax planning as an educator. Remember, by investing time in tax planning, you can educate yourself on financial strategies that will benefit you both in the short term and in the long run.

Understanding the Educator Expense Deduction

As an educator, there are many expenses you incur in your profession. From classroom supplies to professional development costs, these expenses can quickly add up. However, there is a silver lining – the IRS provides a tax deduction specifically designed for educators. This deduction, known as the Educator Expense Deduction, allows eligible educators to deduct up to $250 of qualified out-of-pocket expenses from their taxable income.

So, what exactly qualifies as an eligible expense? The IRS considers expenses such as books, supplies, computer equipment, and even software used for educational purposes as deductible expenses. However, it’s important to note that personal expenses, such as clothing or personal trips, are not eligible for this deduction.

To take advantage of this deduction, educators must meet certain criteria. First, you must work as a teacher, instructor, counselor, principal, or aide for students in kindergarten through grade 12. It’s also important to remember that this deduction is available whether you work in a private or public educational institution. Additionally, you must have paid for these expenses out-of-pocket – expenses reimbursed by your school or any other sources do not qualify for the deduction.

Utilizing the Educator Expense Deduction can provide significant tax benefits for educators. By reducing your taxable income, you ultimately lower the amount of taxes you owe. For example, if you’re in a 22% tax bracket, a $250 deduction would translate to a tax savings of $55. This can be a valuable opportunity to save money and allocate those funds towards other important aspects of your career or personal life.

| Expenses that qualify for the Educator Expense Deduction: | Expenses that do not qualify for the Educator Expense Deduction: |

|---|---|

|

|

It’s important to keep accurate records and save all relevant receipts to support your deduction claims. This way, if the IRS requests documentation to verify your expenses, you’ll be prepared and able to provide the necessary proof.

In conclusion, understanding the Educator Expense Deduction is crucial for educators looking to maximize their tax benefits. By taking advantage of this deduction, you can reduce your taxable income and ultimately lower your overall tax liability. Remember to keep track of your eligible expenses and consult with a tax professional if you have any questions or need guidance on how to claim this deduction.

Maximizing Deductions for Classroom Supplies

As an educator, you know how important it is to provide your students with the best resources and materials for a successful learning experience. However, classroom supplies can quickly add up and become a significant expense. The good news is that you may be eligible to maximize your deductions for classroom supplies when filing your taxes. By taking advantage of these deductions, you can save money and ensure that your students have access to the tools they need to thrive.

One of the key deductions available to educators is the Educator Expense Deduction. This deduction allows you to deduct up to $250 of unreimbursed expenses for classroom supplies directly from your taxable income. This includes items such as books, pencils, art supplies, and other materials used in your teaching activities. It’s important to keep detailed records and save receipts for these expenses, as you will need to provide documentation to support your deduction.

However, it’s worth noting that the $250 limit is per individual taxpayer. If you are married and both you and your spouse are educators, you may each qualify for this deduction, doubling the total amount to $500. This can be a significant benefit, especially considering how much educators often spend out of their own pockets to provide the best learning environment for their students.

Another way to maximize your deductions for classroom supplies is by participating in donation programs. Many schools and educational organizations have programs in place where teachers can receive donated supplies from businesses and community members. By taking advantage of these programs, you can reduce your out-of-pocket expenses and potentially increase your deduction amount.

Additionally, it’s important to keep in mind that not all classroom expenses are eligible for deductions. Expenses that are considered personal or unrelated to your teaching activities, such as clothing or personal care items, cannot be claimed as deductions. It’s crucial to familiarize yourself with the specific guidelines for what qualifies as a deductible expense and what does not.

To help keep track of your expenses and maximize your deductions, it’s a good idea to create a deductions table. This table can include columns for the date of purchase, the type of item purchased, the amount spent, and whether the expense was reimbursed or not. Having this organized record can make it easier when it comes time to file your taxes and claim your deductions.

Exploring Home Office Deductions for Teachers

Are you a teacher who often brings work home with you? Do you have a dedicated space in your home where you grade papers, plan lessons, and complete other teaching-related tasks? If so, you may be eligible for home office deductions as a teacher. In this blog post, we will explore the various home office deductions that teachers can take advantage of to minimize their tax liability and maximize their take-home pay.

One of the key requirements for claiming a home office deduction as a teacher is that the space you use must be regularly and exclusively used for conducting your teaching-related activities. This means that you cannot use your office space for personal purposes, such as for hobbies or as a guest room. Additionally, the room or area in your home must be your principal place of business or where you regularly meet with your students or plan your lessons.

There are two methods you can use to calculate your home office deduction: the simplified method and the regular method. The simplified method allows you to deduct $5 per square foot of your home office space, up to a maximum of 300 square feet. This method is generally easier and less time-consuming to calculate. On the other hand, the regular method requires you to determine the actual expenses associated with your home office, such as mortgage interest, property taxes, utilities, repairs, and depreciation. This method may result in a higher deduction but requires more detailed record-keeping.

It is important to note that the home office deduction for teachers is subject to certain limitations. For instance, you cannot deduct more than your teaching-related income. If you claim the home office deduction, you must also reduce the basis of your home by the amount of the depreciation taken on your tax returns. Additionally, any expenses associated with the portion of your home used for business purposes cannot be deducted as itemized deductions, such as mortgage interest or property taxes.

- Regular and exclusive use: The space used as a home office must be used exclusively for conducting teaching-related activities and on a regular basis.

- Principal place of business: The home office must be your principal place of business or where you regularly meet with your students or plan your lessons.

- Simplified method: The simplified method allows for a deduction of $5 per square foot of your home office space, up to a maximum of 300 square feet.

- Regular method: The regular method requires the determination of actual expenses associated with the home office, such as mortgage interest, property taxes, utilities, repairs, and depreciation.

- Limitations: The home office deduction for teachers is subject to limitations, such as not being able to deduct more than your teaching-related income and reducing the basis of your home by the amount of depreciation taken.

| Method | Advantages | Disadvantages |

|---|---|---|

| Simplified method | Easier and less time-consuming to calculate | May result in a lower deduction compared to the regular method |

| Regular method | Potentially higher deduction | Requires more detailed record-keeping |

Tax Benefits of Professional Development for Educators

As an educator, it is essential to continuously improve your skills and knowledge in order to provide the best education for your students. Luckily, there are several tax benefits available to educators who invest in their professional development. These tax benefits can help offset the costs associated with attending workshops, conferences, and other educational programs.

One of the key tax benefits available to educators is the Educator Expense Deduction. This deduction allows eligible educators to deduct up to $250 of out-of-pocket expenses for classroom supplies. This includes expenses for books, supplies, computer equipment, and other materials used in the classroom. By taking advantage of this deduction, educators can reduce their taxable income and ultimately lower their tax liability.

In addition to the Educator Expense Deduction, educators can also benefit from education-related tax credits. The Lifetime Learning Credit and the American Opportunity Credit are two tax credits available to individuals who are pursuing higher education or taking courses to improve their job skills. These credits can help educators offset the costs of continuing education courses, graduate programs, or other professional development opportunities.

- Educator Expense Deduction: This deduction allows educators to deduct up to $250 for classroom supplies.

- Lifetime Learning Credit: This tax credit can be claimed for qualified education expenses, including professional development courses, up to a maximum of $2,000 per tax return.

- American Opportunity Credit: This credit is available for the first four years of higher education and can be claimed for up to $2,500 of qualified education expenses.

Another tax benefit to consider is the ability to deduct continuing education costs. If an educator takes courses to maintain or improve their skills in their current position, these expenses may be deductible. This includes the cost of tuition, books, and any other necessary materials. It is important to keep detailed records and receipts to support these deductions.

| Tax Benefit | Details |

|---|---|

| Educator Expense Deduction | Allows deduction of up to $250 for classroom supplies. |

| Lifetime Learning Credit | Available for qualified education expenses, up to $2,000 per tax return. |

| American Opportunity Credit | Claim up to $2,500 for the first four years of higher education. |

| Deduction for Continuing Education | Deductible expenses include tuition, books, and necessary materials. |

It is important for educators to take advantage of these tax benefits and maximize their potential savings. By investing in professional development and continuing education, educators not only enhance their skills but also reduce their tax liability. Make sure to consult with a tax professional or utilize tax preparation software to ensure you are taking advantage of all available tax benefits.

Utilizing Education-related Tax Credits

When it comes to tax planning for educators, one area that shouldn’t be overlooked is education-related tax credits. These credits, offered by the IRS, can help educators save money and offset some of the expenses associated with professional development and higher education. By taking advantage of these credits, educators can not only improve their own skills and knowledge but also reap the financial benefits. In this blog post, we will explore some of the key education-related tax credits available to educators.

One of the most commonly used education-related tax credits is the Lifetime Learning Credit. The Lifetime Learning Credit allows educators to claim a credit of up to $2,000 per tax return for qualified education expenses. This credit can be used for expenses such as tuition, fees, books, and supplies related to higher education courses taken to improve professional skills or acquire new knowledge. It’s important to note that this credit is available for both part-time and full-time educators, and there is no limit on the number of years you can claim it.

Another valuable tax credit for educators is the American Opportunity Credit. This credit is specifically designed to assist students in their first four years of post-secondary education. However, educators can also qualify for this credit if they are working towards a degree or improving their teaching skills. The American Opportunity Credit allows educators to claim up to $2,500 per eligible student for qualified education expenses. These expenses include tuition, fees, books, and supplies. To qualify for the full credit, educators must have a modified adjusted gross income of $80,000 or less ($160,000 or less for joint filers).

- • Lifetime Learning Credit: Up to $2,000 per tax return for qualified education expenses.

- • American Opportunity Credit: Up to $2,500 per eligible student for qualified education expenses.

It is important to keep in mind that these tax credits have specific eligibility requirements, and it’s essential to carefully review the IRS guidelines or consult with a tax professional to determine if you qualify. Additionally, it’s crucial to keep track of all eligible expenses and maintain proper documentation to support your claims. By utilizing education-related tax credits, educators can not only invest in their own professional development but also reduce their tax burden.

| Education-Related Tax Credits | Maximum Credit Amount | Eligibility Criteria |

|---|---|---|

| Lifetime Learning Credit | $2,000 per tax return | No limit on the number of years. Expenses should be related to higher education or professional development. |

| American Opportunity Credit | $2,500 per eligible student | Available for the first four years of post-secondary education. Expenses should be related to education or improving teaching skills. |

In conclusion, education-related tax credits can be a valuable tool for educators to minimize their tax liability while investing in their professional growth. By taking advantage of credits such as the Lifetime Learning Credit and the American Opportunity Credit, educators can not only enhance their skills and knowledge but also enjoy financial benefits. It’s important to understand the eligibility criteria and keep proper documentation to support your claims. So, start exploring these education-related tax credits and make the most of the opportunities they offer!

Strategies for Deducting Continuing Education Costs

Continuing education is crucial for professionals in various fields, including educators. Not only does it enhance their knowledge and skills, but it also allows them to stay up-to-date with the latest trends and advancements in their respective industries. However, the cost of continuing education can be a significant burden, especially for teachers who are already managing tight budgets. Thankfully, there are strategies available for deducting the costs of continuing education, which can help educators alleviate some of the financial strain.

One strategy for deducting continuing education costs is to explore the lifetime learning credit provided by the Internal Revenue Service (IRS). With this credit, eligible educators can claim a certain percentage of the qualified expenses they incurred during the tax year. Qualified expenses may include tuition fees, course-related books and supplies, and even transportation costs. It’s important to note that the lifetime learning credit has certain income limitations, so educators should review the IRS guidelines to determine their eligibility for this deduction.

Another strategy that educators can consider is utilizing the above-the-line deduction for continuing education expenses. Unlike itemized deductions, above-the-line deductions can be claimed even if the taxpayer does not itemize their deductions on Schedule A of their tax return. This means that educators can deduct their qualifying continuing education expenses directly from their gross income, reducing their overall taxable income. However, it’s essential to keep accurate records and receipts of all eligible expenses to support the deduction claim.

Additionally, employers can play a significant role in assisting educators with deducting continuing education costs. Some employers offer reimbursement programs or provide education benefits as part of their employee benefits packages. These benefits could include tuition reimbursement, scholarships, or grants for employees pursuing further education. By taking advantage of these offerings, educators can reduce their out-of-pocket expenses and potentially increase the amount they can claim as a deduction.

It’s important for educators to stay informed about the various tax benefits available to them when it comes to continuing education costs. By strategically utilizing the lifetime learning credit, above-the-line deductions, and employer-provided education benefits, educators can maximize their potential deductions and alleviate some of the financial burdens associated with ongoing professional development. Remember to keep records of all expenses and consult with a tax professional to ensure you are taking full advantage of the available deductions within the IRS guidelines.

| Key Strategies for Deducting Continuing Education Costs |

|---|

| 1. Lifetime Learning Credit |

| Take advantage of the IRS lifetime learning credit, which allows eligible educators to claim a percentage of qualified expenses for continuing education. |

| 2. Above-the-Line Deduction |

| Consider utilizing the above-the-line deduction for continuing education expenses, which allows educators to deduct qualifying expenses directly from their gross income. |

| 3. Employer Assistance |

| Explore employer-provided education benefits such as tuition reimbursement or scholarships to reduce out-of-pocket expenses and increase potential deductions. |

Navigating Retirement Contributions and Tax Benefits

Retirement planning is essential for everyone, including educators. As teachers and educators, it is crucial to understand the various retirement contributions and tax benefits that may be available to you. By taking advantage of these opportunities, you can better prepare for a financially secure future. Let’s explore some strategies and options for navigating retirement contributions and maximizing tax benefits.

One common retirement contribution option available to educators is a 403(b) plan, also known as a tax-sheltered annuity. This type of retirement plan allows educators to contribute a portion of their salary on a pre-tax basis. By doing so, you lower your taxable income, effectively reducing your tax liability. It’s important to note that contributions to a 403(b) plan are limited to a certain amount each year, so it’s wise to contribute as much as you can afford to maximize your retirement savings.

In addition to the tax advantages provided by a 403(b) plan, educators may also be eligible for a tax credit called the Saver’s Credit. This credit is designed to encourage retirement savings for low to moderate-income individuals. Depending on your income level and filing status, you may be eligible for a credit of up to $2,000 for contributions to a retirement account. This credit can help offset the costs of retirement contributions and provide an additional boost to your overall retirement savings.

- Maximize Employer Matching: Many educational institutions offer employer matching programs for retirement contributions. If your employer offers a matching program, be sure to contribute at least the maximum amount that they will match. This is essentially free money that can significantly enhance your retirement savings.

- Consider Roth Options: While traditional retirement plans, such as a 403(b) plan, offer tax-deferred growth, Roth retirement plans allow for tax-free withdrawals in retirement. Educators may have access to a Roth 403(b) plan or a Roth IRA. These options can be beneficial if you expect your tax rate to be higher in retirement or if you want tax diversification in your retirement savings.

- Stay Informed: Tax laws and retirement plan regulations can change over time. It’s important to stay informed and keep up-to-date with any changes that may impact your retirement contributions and tax benefits. Consult with a tax professional or financial advisor who specializes in retirement planning for educators to ensure you are maximizing your savings and taking advantage of any available tax deductions or credits.

| Retirement Contribution | Tax Benefit |

|---|---|

| 403(b) Plan | Pre-tax contributions reduce taxable income |

| Saver’s Credit | Potential tax credit of up to $2,000 for retirement contributions |

| Employer Matching | Free money that enhances retirement savings |

| Roth Options | Tax-free withdrawals in retirement |

Planning for retirement as an educator may seem overwhelming, but understanding the retirement contribution options and tax benefits available to you can make the process more manageable. By contributing to a retirement plan, such as a 403(b) plan, maximizing employer matching, considering Roth options, and staying informed about tax regulations, you can take steps towards a secure and prosperous retirement. Remember, consulting with a professional is always a good idea to ensure you are making the best decisions for your financial future.

Frequently Asked Questions

1. How does the Educator Expense Deduction work?

The Educator Expense Deduction allows eligible educators to deduct up to $250 of out-of-pocket expenses spent on classroom supplies from their taxable income.

2. What expenses can be included in the Educator Expense Deduction?

Expenses that can be included in the Educator Expense Deduction are those incurred for the purchase of books, supplies, computer equipment, and other materials used in the classroom.

3. Are there any limitations or requirements for claiming the Educator Expense Deduction?

To claim the Educator Expense Deduction, you must be a K-12 teacher, instructor, counselor, principal, or aide who works at least 900 hours during the school year in a school that provides elementary or secondary education.

4. How can teachers maximize deductions for classroom supplies?

Teachers can maximize deductions for classroom supplies by keeping detailed records of their out-of-pocket expenses and saving receipts. Additionally, teachers can consider organizing a classroom supply drive to collect donated items, which can also be deductible.

5. What are the requirements for claiming home office deductions for teachers?

To claim home office deductions, teachers must use a designated space in their home exclusively for conducting administrative or educational activities and it must be their principal place of business.

6. What tax benefits are available for professional development expenses for educators?

Educators can qualify for tax benefits by deducting expenses related to professional development courses, conferences, workshops, and seminars that enhance their teaching skills and improve their job performance.

7. What education-related tax credits can educators utilize?

Educators can utilize tax credits such as the Lifetime Learning Credit and the American Opportunity Credit to offset education expenses for themselves or their eligible dependents.