Understanding tax implications for rental property owners

Understanding Tax Implications for Rental Property Owners

When it comes to owning rental properties, it’s essential to have a clear understanding of the tax implications involved. Failing to comply with tax regulations can lead to penalties and unnecessary financial burdens. To avoid such issues, landlords must be knowledgeable about the various tax rules and leverage strategies to maximize deductions and minimize tax liabilities.

One crucial aspect of tax implications for rental property owners is keeping accurate records of rental property income and expenses. It is vital to maintain meticulous records throughout the year to ensure accurate reporting. This includes documenting all rental income, such as monthly rent payments, late fees, and security deposits. Additionally, landlords should keep track of expenses associated with the property, including mortgage interest, property taxes, maintenance costs, and insurance premiums.

Another essential concept to grasp is how to utilize depreciation to maximize tax deductions. Depreciation allows landlords to deduct a portion of the property’s value over time to account for wear and tear. This tax benefit can significantly reduce rental property owners’ taxable income, thus lowering their overall tax liability. Understanding the different methods of depreciation, such as straight-line or accelerated, is essential in implementing the most advantageous strategy for tax purposes.

Landlords should also consider the option of expensing repairs and maintenance costs for their rental properties. While large-scale improvements are typically capitalized and depreciated over time, routine repairs and maintenance expenses can often be deducted in the same year they occur. This includes expenses such as painting, fixing plumbing issues, or repairing appliances. By properly documenting and deducting these costs, rental property owners can further reduce their taxable income.

| Expense Type | Deductible? |

|---|---|

| Routine Repairs | Yes |

| Capital Improvements | No – Capitalized and Depreciated |

Furthermore, rental property owners should explore deductions for home office use in their property management activities. If landlords use a dedicated space in their homes for rental property management tasks, they may be eligible for additional tax deductions. This could include a percentage of home expenses such as mortgage interest, insurance, utilities, and even depreciation for that specific space.

It is also crucial to understand and take advantage of all deductible rental property expenses. Deductions can range from advertising and legal fees to property management fees and travel expenses related to the rental property. By identifying and maximizing these deductions, landlords can significantly reduce their tax burden and increase their net income from rental properties.

For individuals owning both short-term and long-term rental properties, it is essential to navigate the specific tax rules governing each. Short-term rentals, such as those on Airbnb or vacation rentals, may have different tax implications compared to traditional long-term rentals. Understanding the differences in reporting requirements and eligible deductions can help rental property owners optimize their overall tax strategy.

Lastly, implementing tax-saving strategies for rental property investments is crucial. This includes structuring rental property ownership in a tax-efficient manner, such as forming an LLC or utilizing a 1031 exchange for property exchanges. Additionally, proper timing and planning for property sales can also lead to significant tax savings.

In conclusion, understanding the tax implications for rental property owners is vital for effective property management and minimizing tax liabilities. By keeping accurate records, utilizing depreciation, expensing repairs and maintenance costs, exploring deductions, navigating tax rules for short-term versus long-term rentals, and implementing tax-saving strategies, landlords can optimize their tax strategy and maximize their profitability from rental properties.

Keeping accurate records of rental property income and expenses

When it comes to managing rental properties, it is crucial to keep accurate records of both income and expenses. Maintaining detailed and organized records can save you time, money, and potential headaches during tax season. In this blog post, we will explore the importance of keeping accurate records, the type of records you should keep, and some tips to help you stay organized.

One of the main benefits of keeping accurate records is the ability to properly report your rental property income. Rental income is considered taxable by the Internal Revenue Service (IRS), and it is essential to include all rental income on your tax return. Failure to accurately report your rental income could potentially result in penalties or an audit. By maintaining detailed records, you can easily track the rental payments received, including any late fees or additional charges.

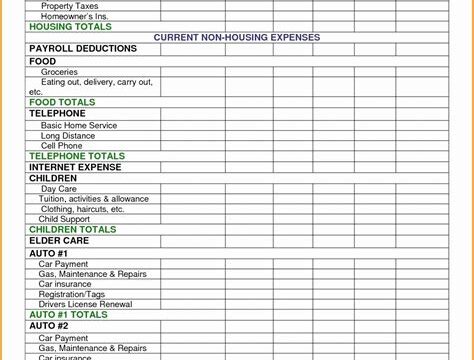

In addition to income, it is equally important to keep thorough records of your rental property expenses. These expenses include mortgage payments, property taxes, insurance, repairs, and maintenance costs, among others. By accurately tracking and documenting these expenses, you can potentially lower your tax liability and maximize deductions. The key is to maintain a clear distinction between personal and rental expenses.

- Document rental income: Keep records of tenant payments, security deposits, late fees, and any other sources of rental income. Make sure to include the date received, the amount, and the purpose of the payment.

- Track expenses: Create a system to record and categorize all rental property expenses. This can be done manually using spreadsheets or by utilizing accounting software specifically designed for rental property management.

- Separate personal and rental expenses: Open a dedicated bank account and credit card for your rental property business. This approach will help streamline expense tracking and make it easier to differentiate between personal and rental-related expenditures.

| Expense Category | Examples |

|---|---|

| Mortgage Payments | Monthly principal and interest payments |

| Property Taxes | Annual property tax payments |

| Insurance | Property and liability insurance premiums |

| Repairs and Maintenance | Costs for fixing appliances, plumbing, and general maintenance |

By keeping accurate records, you not only ensure compliance with tax regulations but also gain better insight into the financial performance of your rental property business. Accurate records can help you analyze expenses, identify areas for improvement, and make informed business decisions. Moreover, if you ever decide to sell your rental property, well-organized records will facilitate the process and potentially reduce the time required to complete the transaction.

Overall, keeping accurate records of rental property income and expenses is a crucial aspect of successful property management. It not only helps you maintain compliance with tax laws but also allows for better financial management and decision-making. Remember to document rental income, track expenses diligently, and keep personal and rental expenditures separate. With these practices in place, you can confidently navigate the world of rental property ownership.

Utilizing depreciation to maximize tax deductions

In order to maximize tax deductions for rental property owners, it is essential to understand and utilize depreciation. Depreciation is a tax deduction that allows property owners to write off the cost of their property over a period of time, typically 27.5 years for residential rental properties and 39 years for commercial properties. This deduction acknowledges the gradual wear and tear, deterioration, and obsolescence of the property.

The first step in utilizing depreciation is to determine the basis of the property. The basis includes the purchase price, closing costs, and other expenses directly related to the acquisition of the property. It is important to keep accurate records of these costs to ensure maximum deductions.

Once the basis is determined, the property owner can calculate the annual depreciation deduction. This is done by dividing the basis by the number of years of the property’s useful life. For example, if the basis of a residential rental property is $200,000 and the useful life is 27.5 years, the annual depreciation deduction would be approximately $7,273.

| Year | Basis | Depreciation Expense | Accumulated Depreciation |

|---|---|---|---|

| 1 | $200,000 | $7,273 | $7,273 |

| 2 | $200,000 | $7,273 | $14,546 |

| 3 | $200,000 | $7,273 | $21,819 |

As shown in the table above, the depreciation expense is deducted each year and accumulated over time. This deduction can significantly reduce the property owner’s taxable income.

It is important to note that in order to claim the depreciation deduction, the property must be used for income-producing purposes. Additionally, if the property is sold, the depreciation deduction must be recaptured and added back to the owner’s taxable income.

Utilizing depreciation to maximize tax deductions is a valuable strategy for rental property owners. By accurately calculating and claiming this deduction, property owners can reduce their tax liability and increase their overall profitability. Remember to consult with a tax professional or accountant for specific advice and guidance tailored to your individual circumstances.

Expensing repairs and maintenance costs for rental properties

When it comes to owning a rental property, there are various costs that need to be taken into account. One essential aspect of managing these properties is understanding the tax implications involved. One such aspect is expensing repairs and maintenance costs. In this blog post, we will explore the importance of expensing these costs and how it can benefit rental property owners.

When repairs and maintenance are necessary for a rental property, they can be quite costly. However, it is crucial for property owners to know that these expenses can be deducted from their taxes. By expensing these costs, owners can reduce their taxable income and ultimately pay less in taxes. This is a significant advantage for rental property owners as it helps to offset some of the financial burdens that come with managing such properties.

It is important to note that not all repairs and maintenance costs can be expensed. The IRS has specific guidelines on what expenses can be deducted. Generally, repairs that are necessary to keep the property in good condition can be expensed. This includes things like fixing a leaky roof, repairing broken windows, or replacing a faulty plumbing system. However, it is crucial to keep accurate records and receipts of all repair expenses to support any deductions claimed.

- Keep track of all repair and maintenance expenses.

- Separate repairs from improvements.

- Understand the difference between repairs and capital expenses.

- Consult a tax professional for guidance.

- Be aware of any specific tax laws or regulations regarding rental properties in your area.

In addition to repairs, maintenance costs can also be expensed. Regular upkeep, such as painting, cleaning, and landscaping, can be deducted as long as it is necessary to maintain the property’s condition. It is crucial to differentiate between repairs and improvements when expensing maintenance costs. Improvements, which enhance the value of the property or extend its useful life, cannot be expensed but can be depreciated over time.

Expensing repairs and maintenance costs is a vital aspect of managing rental properties. By deducting these expenses, property owners can reduce their taxable income and lighten the financial burdens that come with property management. However, it is crucial to understand the specific rules and guidelines set by the IRS to ensure accurate and legitimate deductions. By keeping accurate records and consulting with a tax professional, rental property owners can maximize their tax deductions and effectively manage their properties.

| Key Takeaways |

|---|

| Expensing repairs and maintenance costs is crucial for rental property owners to reduce their taxable income. |

| It is important to keep accurate records and receipts of all repair expenses to support deductions claimed. |

| Regular maintenance costs can be deducted as long as they are necessary to maintain the property’s condition. |

| Understanding the difference between repairs, improvements, and capital expenses is essential to correctly expense maintenance costs. |

| Consulting a tax professional can provide valuable guidance in navigating tax laws and regulations for rental properties. |

Exploring deductions for home office use in rental property management

When it comes to rental property management, there are a variety of tax deductions that owners can take advantage of. One such deduction is for the use of a home office in the management of rental properties. By exploring these deductions, property owners can potentially reduce their tax liability and increase their overall profitability.

One important aspect to consider when claiming deductions for a home office is understanding the specific requirements set by the Internal Revenue Service (IRS). In order to qualify for this deduction, the home office must be used exclusively for business purposes. This means that a room or designated area within the owner’s home must be used solely for activities related to the management of rental properties.

Additionally, it is important to keep accurate records of the expenses associated with the home office, including utilities, rent or mortgage payments, insurance, and maintenance costs. These records will be essential when it comes time to file taxes and claim the deduction. Keeping detailed records can help ensure that all eligible expenses are accounted for, maximizing the deduction and reducing the risk of an IRS audit.

When utilizing the home office deduction, it is also crucial to understand the limitations and guidelines set by the IRS. The deduction is based on the percentage of the home’s square footage that is used for the home office. For example, if the home office occupies 10% of the total square footage of the home, then 10% of the eligible expenses can be deducted.

To further explore the deductions for home office use in rental property management, it is important to consider the specific expenses that can be claimed. These may include costs related to office supplies, furniture, equipment, and even internet and phone services. By understanding and properly documenting these expenses, rental property owners can maximize their deductions and ultimately reduce their overall tax burden.

By exploring the deductions for home office use in rental property management, owners can potentially save significant amounts of money on their taxes. However, it is important to consult with a tax professional or advisor to ensure that all deductions are claimed correctly and in compliance with IRS regulations. Taking advantage of these deductions can not only reduce tax liability but also increase the profitability of rental property investments.

Taking advantage of deductible rental property expenses

Taking advantage of deductible rental property expenses is an essential aspect of managing rental properties and maximizing your tax benefits. As a rental property owner, it is crucial to understand the various expenses that can be deducted from your rental income, resulting in potential tax savings.

One important deductible expense for rental property owners is mortgage interest. If you have a mortgage on the rental property, the interest paid on that loan can be deducted from your rental income. This deduction can significantly reduce your taxable income and lower your overall tax liability.

Another deductible expense is property taxes. As a rental property owner, you are responsible for paying property taxes on the property. Fortunately, these taxes can also be deducted from your rental income. Keep track of the amount you paid in property taxes throughout the year, as this will be an important figure when calculating your deductible expenses.

In addition to mortgage interest and property taxes, you can also deduct expenses related to the maintenance and repairs of your rental property. Repairs such as fixing a leaky roof or replacing a broken appliance are all deductible expenses. These costs can add up over time, so keeping detailed records of these expenses is essential.

Furthermore, it’s worth noting that expenses for advertising and marketing your rental property can also be deducted. Whether you’re creating online listings or printing flyers, these expenses can help reduce your taxable rental income.

When it comes to deductible rental property expenses, it is essential to keep accurate records to support your claims. Maintaining receipts, invoices, and any other relevant documentation can help provide evidence of your expenses. It’s also a good idea to consult with a tax professional who specializes in rental property investments to ensure you are maximizing your deductions and taking full advantage of available tax benefits.

In conclusion, taking advantage of deductible rental property expenses is a smart strategy for rental property owners. By understanding the various deductible expenses, such as mortgage interest, property taxes, maintenance and repairs, and advertising costs, you can effectively reduce your taxable rental income and potentially save on taxes. Remember to keep thorough records and seek professional advice to ensure compliance with tax regulations and optimize your tax benefits.

Navigating tax rules for short-term versus long-term rental properties

When it comes to owning and renting out properties, understanding the tax implications is crucial. One aspect that landlords need to navigate is the tax rules for short-term versus long-term rental properties.

Short-term rental properties, such as vacation rentals or properties rented out on platforms like Airbnb, typically refer to renting out a property for less than 30 days at a time. On the other hand, long-term rental properties are those rented out for an extended period, usually for six months or longer.

It’s important to note that the tax rules for short-term and long-term rental properties differ in several ways, including how rental income is treated for tax purposes. For short-term rentals, the income generated is typically considered as business income, while for long-term rentals, it is usually seen as rental income. This distinction is crucial as it affects how these incomes are reported and taxed.

Additionally, the expenses you can deduct may vary for short-term and long-term rentals. For short-term rentals, you can typically deduct expenses such as cleaning fees, property management fees, and advertising costs. However, for long-term rentals, you may be able to deduct a broader range of expenses, including property repairs, insurance premiums, and even travel expenses for property-related activities.

- Short-term rental properties:

- Rental income is considered business income.

- Deductible expenses may include cleaning fees, property management fees, and advertising costs.

- Long-term rental properties:

- Rental income is considered rental income.

- Deductible expenses may include property repairs, insurance premiums, and travel expenses related to managing the property.

It’s crucial to keep accurate records of your rental property income and expenses to ensure compliance with tax rules and maximize your deductions. Maintaining organized records will not only make it easier to file your taxes but also provide evidence and support in case of an audit.

In conclusion, navigating the tax rules for short-term versus long-term rental properties is necessary for landlords to properly manage their tax obligations. Understanding the differences in how rental income is categorized and which expenses are deductible is essential for accurate reporting and maximizing tax deductions. By keeping accurate records and staying informed about tax regulations, landlords can ensure that they are in compliance and make the most of their rental property investments.

Implementing tax-saving strategies for rental property investments

Investing in rental properties can be a lucrative venture, but it also comes with financial responsibilities. As a rental property owner, it is important to effectively manage your tax obligations to maximize your returns. By implementing smart tax-saving strategies, you can optimize your rental property investments and minimize your tax liabilities. This blog post will explore various strategies that can help you achieve these goals.

1. Take advantage of property depreciation:

One key tax-saving strategy for rental property owners is utilizing property depreciation. The IRS allows you to deduct a portion of the property’s value over time to account for wear and tear. This tax deduction can help lower your taxable rental income, resulting in reduced taxes. Be sure to consult a tax professional or use tax software to accurately determine the depreciation amount and claim this deduction on your tax return.

2. Deduct rental property expenses:

Another effective strategy is to take advantage of deductible rental property expenses. These can include costs such as property maintenance, repairs, insurance premiums, property management fees, and even legal and professional services. Keeping accurate records of these expenses is crucial for properly claiming deductions. By deducting these expenses from your rental income, you can reduce your taxable income and ultimately pay less in taxes.

3. Consider a 1031 exchange:

A 1031 exchange, also known as a like-kind exchange, is a tax-deferment strategy that can be beneficial for rental property investors. Essentially, it allows you to sell a property and reinvest the proceeds into a similar property without incurring immediate tax consequences. By utilizing a 1031 exchange, you can defer capital gains taxes and continue to grow your wealth through investments. However, it is important to comply with the specific rules and deadlines set by the IRS for a successful exchange.

| Tax-saving Strategy | Benefits |

|---|---|

| Property Depreciation | Reduces taxable rental income |

| Deductible Rental Property Expenses | Lowers taxable income |

| 1031 Exchange | Defers capital gains taxes |

Implementing tax-saving strategies for rental property investments can significantly impact your overall financial success. By taking advantage of property depreciation, deducting rental property expenses, and considering a 1031 exchange, you can optimize your tax savings and increase your investment returns. Remember to consult with a tax professional to ensure you comply with all tax regulations and make the most of these strategies.

Frequently Asked Questions

Question 1: What are the tax implications for rental property owners?

The tax implications for rental property owners include reporting rental income on their tax return and potentially paying taxes on that income. They may also be eligible for various tax deductions and credits related to owning and maintaining a rental property.

Question 2: Why is it important to keep accurate records of rental property income and expenses?

Keeping accurate records of rental property income and expenses is crucial for several reasons. It helps rental property owners to accurately report their rental income and claim eligible deductions, reduces the chances of making mistakes in tax filings, and provides documentation in case of an audit by the tax authorities.

Question 3: How can depreciation be utilized to maximize tax deductions for rental properties?

Depreciation allows rental property owners to deduct a portion of the property’s value over its useful life as an expense. By properly calculating and claiming depreciation, owners can maximize their tax deductions and reduce their taxable rental income.

Question 4: Can repairs and maintenance costs for rental properties be expensed?

Yes, repairs and maintenance costs for rental properties can be expensed as deductible expenses. However, it is important to differentiate between repairs (deductible) and improvements (capital expenses), as only repairs can be immediately expensed, while improvements may need to be depreciated over time.

Question 5: What deductions can be explored for home office use in rental property management?

Rental property owners who use a portion of their home exclusively for rental property management purposes may be able to claim deductions for their home office. These deductions can include a percentage of home-related expenses such as utilities, insurance, and mortgage interest, based on the proportion of the home used for business.

Question 6: What are some deductible rental property expenses that owners can take advantage of?

Some deductible rental property expenses that owners can take advantage of include property taxes, mortgage interest, insurance premiums, property management fees, advertising costs, repair and maintenance expenses, legal and professional fees, and utilities paid by the owner.

Question 7: How do tax rules differ for short-term and long-term rental properties?

Tax rules for short-term rental properties (usually rented for less than 30 days at a time) and long-term rental properties (typically rented for longer periods) differ in several aspects. Short-term rentals may be subject to additional local taxes, while long-term rentals may qualify for certain tax incentives. Additionally, the reporting and deduction rules can vary depending on the rental duration.